Everything about Retirement Planning

Wiki Article

Indicators on Retirement Planning You Should Know

Table of ContentsThe Main Principles Of Retirement Planning The Only Guide to Retirement PlanningAll about Retirement PlanningAll About Retirement PlanningThe smart Trick of Retirement Planning That Nobody is Discussing

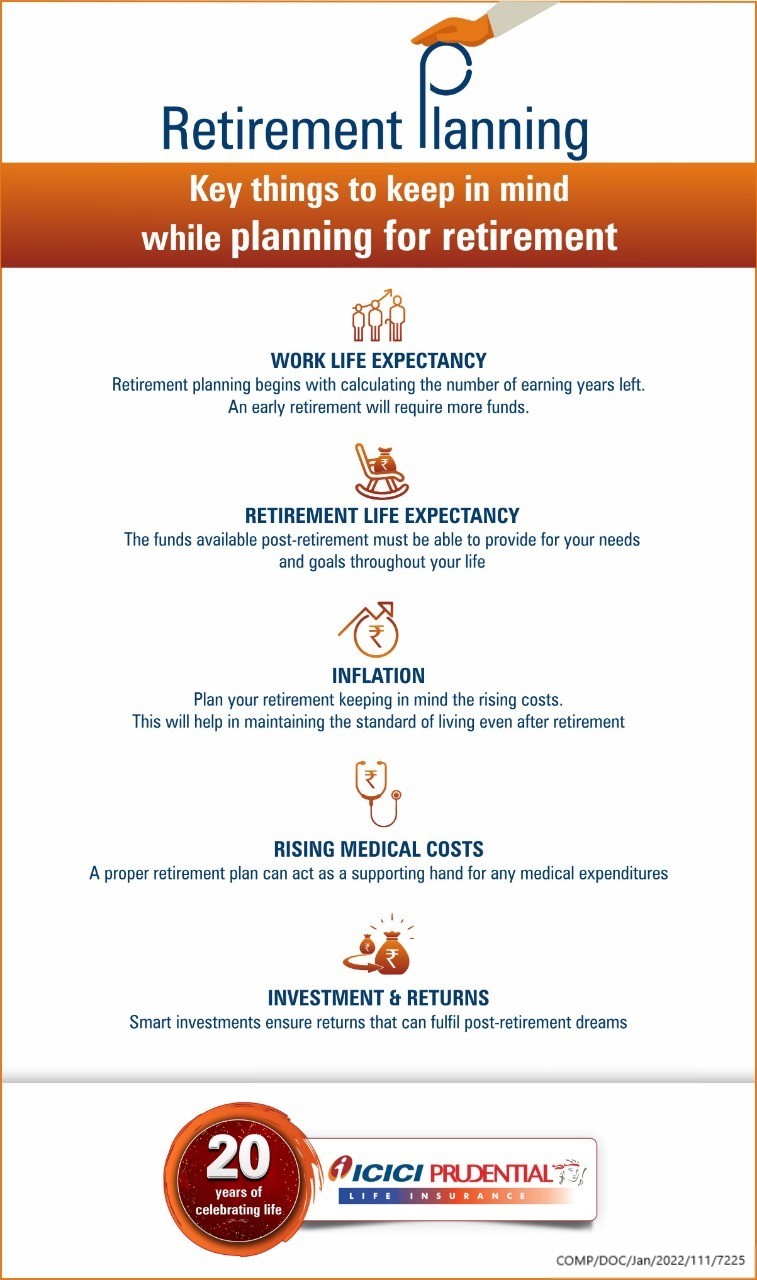

A cornerstone of retirement preparation is identifying not just just how much to conserve, however likewise where to conserve it. If you have a 401(k) or various other employer retired life strategy with matching bucks, think about beginning there. If you do not have a workplace retirement, you can open your own pension.In general, the finest plans offer tax obligation benefits, and, if available, an additional savings incentive, such as matching contributions. Some workers are missing out on out on that complimentary cash.

There are several networks you can utilize to save for retired life. Devoted retirement have the benefit of tax-free growth on your cost savings, and also you likewise receive tax obligation deductions from your contributions in your yearly income tax return. Some retirement in South Africa are established up by your company with contributions coming from your salary.

To aid you recognize the various retirement strategy options, benefits, as well as demands, we've created this retirement preparation overview that you can describe when considering your retirement plan:: A pension plan fund is made use of to save for retired life as well as receives regular payments (typically month-to-month) from you as well as your employer.

The Ultimate Guide To Retirement Planning

: A provident fund is similar to a pension plan fund, with the difference that when you resign or retire, you can take the entire savings amount as money if you want. You do not require to purchase a revenue plan, however you will certainly be tired on the money payout based on the round figure tax obligation table.Something went wrong. Wait a minute and attempt again. Try once more.

Points do not constantly go to strategy. Simply consider just how COVID-19 has actually affected the jobs market. For anybody reading right into the stats, older employees were more substantially influenced by the pandemic. Beyond the unpredictabilities of financial downturns, firms close down constantly and job features come to be redundant as innovation and requires modification.

Your choice to keep infiltrating your retired life may not constantly be yours to decide. A crash or retrenchment may burglarize you of your ability to remain employed and also earn a salary at any moment. Should anything occur to your family members, you might additionally locate it essential to require time off work to look after your loved one.

How Retirement Planning can Save You Time, Stress, and Money.

The pace of adjustment in the operating globe is accelerating, and your skillset may be obsoleted if you have remained out of the labor force for several years off to recover from, or look after a person with, a clinical problem. To support against potential financial effects of the uncertainties life will throw your way, you are normally urged to:.This is an excellent alternative if you appreciate your job or wants to continue generating earnings in retired life. Sometimes called a sabbatical, these brief durations of leisure take area in between various jobs or encore jobs. You may take a number of months or a complete year to take a trip, for example, prior to heading back right into the world of work.

Countless people use the device to see what they can do to help improve their chances of retired life success. You need to additionally believe regarding exactly how you will certainly spend for clinical and also long-lasting care expenditures in retirement. Some individuals believe that Medicare will certainly cover click to investigate most or perhaps every one of their healthcare expenditures in retirement.

One method to approach retired life monetary planning is to plan by life stage. Simply put, what retired life preparation steps should you be taking at each of the crucial phases of your life? Right here are a couple of guidelines to help you with life phase retirement monetary preparation. While young adults that are just beginning their occupations may not have a great deal of cash to devote to retirement savings, they do have another thing operating in their support: time.

Rumored Buzz on Retirement Planning

They might have started a household as well as presumed economic obligations like a home mortgage, life insurance, numerous car settlements, as well as all of the expenses included in elevating kids as well as paying for their education. With completing priorities, it's crucial to set particular and achievable goals. Fortunately is that these are frequently the height gaining years for many individuals and also couples, providing a chance to make a last solid press towards the retirement finish line by maxing out payments to retirement savings plans.If you stop functioning, not just will you shed your paycheck, yet you may additionally shed employer-provided health and wellness insurance., a lot of people will not be covered by Medicare till they reach age 65.

If you were offered an interest-free lending for thirty years, would certainly you take it? With any luck the solution is yes, considering that you could benefit for decades off the 'free' financial investment returns of that money. That is essentially the manage a lot of retirement programs, where the federal government financings you the money you would have paid in taxes on your revenue as well as you do not have to pay it back till retired life (possibly at a lower tax obligation rate).

Countless individuals utilize the device to see what they can do to help improve their possibilities of retirement success. You must likewise consider just how you will pay for medical and long-lasting care expenses in retirement. Some people assume that Medicare will certainly cover most or also all of their health care expenses in retired life.

Some Known Details About Retirement Planning

One blog method to strategy retired life monetary preparation is to strategy by life stage. In various other words, what retirement preparation actions should you be taking at each of the key phases of your life?

If you quit working, not just will you lose your income, yet you might likewise shed employer-provided medical insurance. there are exceptions, lots of people will certainly not be covered by Medicare up until they get to age 65. Your employer ought to have the ability to inform you if you will certainly have health and wellness insurance benefits after you retire or if you are qualified for short-term extension of health protection.

If you were provided an interest-free financing for three decades, would certainly you take it? Hopefully the solution is of course, given that you could benefit for years off the 'free' financial investment returns of that money. That is essentially the manage visit the site many retired life programs, where the federal government financings you the money you would have paid in tax obligations on your income and also you do not have to pay it back until retirement (possibly at a reduced tax obligation rate).

Report this wiki page